Many DevOps software companies are the classic example of the early VC funding miscalculation that is going to leave employees with stock close to worthless at companies who never achieve their projected valuation.

DevOps is the term of art for much faster, more agile software development requiring the tools to make apps come out much faster.

Major corporations learned the painful lessons of taking years to develop and deploy an application only to be bypassed by nimbler companies who could get an app out, on a phone, in days. DevOps became one of the “solutions” that just might give IT dinosaurs a chance to compete.

DevOps in not a category, like database, where all the vendor participants deliver products that generally do the same thing. Instead, DevOps is a little world unto itself. There are scores of vendors delivering browser testing, app testing, configuration management, code release management and within each of these slices, there are multiple players.

These products are bought by the lowest levels in IT, often people who buy them with credit cards.

This week, one of them, Puppet, announced it had “successfully” closed another venture round of $42 million.

Reading the glowing press release might make one think this is another huge step forward to wealth and fortune for the people who are making it happen. Then one might want to read a little farther.

These guys do something called configuration management. That means they detail and update the info relating to enterprise software and hardware so when low level sys admins do a new software release, config problems are reduced. They share the market with another such entrant, Chef and a score of minor players, too numerous to note.

Puppet and Chef have been around for about 10 and 13 years respectively. In 13 years, Puppet does not appear to have ever made a profit. At least they do not have press releases noting that–and from reading their releases that seem to glow about just about anything, they would have taken out billboards in Kansas if they ever had. Does not look like Chef ever made a dime either–or if they have, they have kept it a national secret.

Puppet revenues are not reported, but estimated by other sites to be in the $100 million range.

So here they are with a reported $150 million in VC funding, selling a product that is used by the Sys Admin, the lowest possible level of the IT food chain. And a major part of their customer base uses the “open source” version. That means the free one—yeah, you got it, the one they do not have to buy.

And they have yet to make a profit.

This is what one calls the Dead Zone.

This is what a company looks like when it has tired investors who cannot let it die but not enough market opportunity or price point to ever break out of this death trajectory.

Let’s do some math here. $150 million invested. The minimum return a VC wants is 10x. More like 30x or 40x, but for now, let’s say just 10. So in order to go public, or get bought out as a win, they need to establish a valuation of $1.5 billion.

Never happen.

Here is a company selling to people who live at the command line prompt. They sell a “land and expand” solution (that means sell little licenses, with highly paid sales staff, then come back and sell to the guy in the next cubicle, next quarter).

Land and expand is the definition of transaction level selling—low level sales, low price, low valuation, long, expensive sales cycles to the low level people in the org, large up front costs, revenue down the road—hopefully.

So they are acquiring other companies and building new capabilities. In a recent Gartner article, the writer noted the following about a Puppet offering: “Much of the company’s strategic value centers on efficiencies……that have yet, and are unlikely, to materialize.”

Ouch! Scale that.

And who has paid for this madness? You got it—the employees who are working there and getting stock options that will never live up to what they likely expect.

Let’s not pick on this little company. They have fine products. They have great investors. They are probably really nice people. But they cannot live up to the hype and ever hit a valuation that escapes the massive dilution for the employees.

They have lots of company. Try Chef, where they turn over sales VPs more often than your local Starbucks turns over baristas, none ever seeming to get them where they want to go.

Both seem to turn over exec after exec, each with a glowing press release about how happy the new person is to be there to deliver “execution” on “our strategy.” So these guys have been around for 10 and 13 years and have not quite gotten execution down?

If execution were the problem, one of the endless sales VPs would have stumbled upon it and reached the equity exit event. But, no, not here.

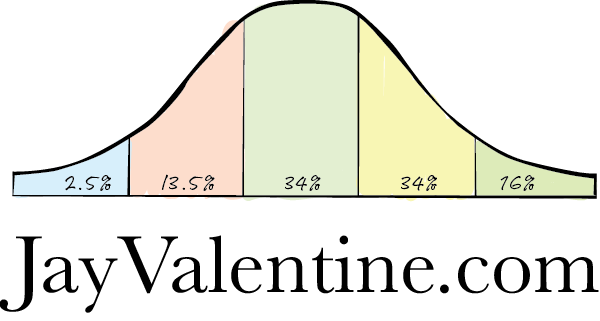

What causes this situation where firms get endless rounds of VC money and never break out? They are so diluted their options are almost worthless—on C, D, E, F rounds.

The A-level employees left a decade ago and have been constantly replaced by the talentless masses who inhabit the D, E , F round companies focusing on “getting execution right.”

Much of the cause is early private equity.

Early private equity makes companies do stupid things fast.

So the VC “partners” force the injection of sales steroids into the main arteries of these firms. The steroids come in the form of very expensive sales and marketing machines, Marketo SPAM inbound marketing, and quarterly revenue madness.

The only certain result is the massive costs as each sales VP brings in his or her team, they fail to hit exit trajectory, then the next one comes in, repeat, repeat, then, guess what—you are on a Series D or E round.

There is a better way.

Let’s look at our pals at Browserstack. This is another firm in the same DevOps space. They do browser testing so one’s app runs the same on all devices, regardless of the browser.

They never took in private equity, they ran their company, thinly, and profitably for years, then took in a massive Series A round. Their equity was accretive—-every dollar accelerated movement. Their employees gained wealth, value. Their customers are looking at a company with staying power.

They are entering the market when their competitors are exhausted—and inhabited and led by the C level players from Chef, Puppet and the scores of other almost dead DevOps players on their wobbly financial legs.

The difference is one’s cap chart.

A Browserstack, Atlasssian and a few others have done it the right way—they started with profit and moved to growth.

These other dead men walking started with growth, or trying for it and — well, never quite moved to profit.

Maybe there is a lesson here.

ContingencySales.com brings disruptive technologies to market without early venture capital. ContingencySales.com has portfolio firms in similarity search, data in use security, fraud detection, relationship management, software appliance and IoT.