SaaS Software Needing the 40% Rule for Liquidity

One would think with the stock market as hot as it is, now would be a great time to bring in new venture capital money. And for some it is.

Browserstack, for instance.

Then there are the walking dead who do not meet the 40% rule.

Chef, Puppet, DevOps Testing companies, scores of OpenSource companies—they’re everywhere.

What is the 40% rule? How does it apply to the SaaS software company?

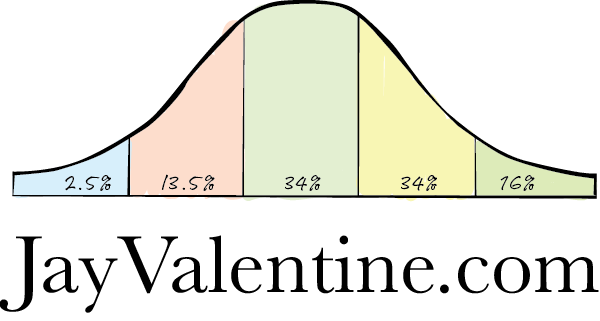

Well, it is becoming the conventional wisdom for VC investment in companies who are not DEAD. So this 40% measures life on two axes: Growth and Profitability.

A candidate company can have zero growth and 40% profit. Or it can have zero profit and 40% growth. Or it can have 20% profit and 20% growth. Or even losses of 40% and 80% growth. In every case, (trust me those in Marcom or HR), this adds up to a positive 40%.

There is life here — these companies get funded without a down round or the private equity vultures buying it for 1X or 2X revenues.

This is now the life measurement of a SaaS software company.

If you are 10 years old, SaaS, have a revenue stream in a few tens of millions, this is how investors now put the mirror up to your quivering lips to determine if there is breath. This is how you, the software engineer, likely being screwed with massively diluted options, can feel if there is life in your company or, well, death.

This is how you, the sought after candidate engineer, can see if those options are worth anything or not.

We all know that VP of Culture, a hapless HR type who gives out VISA $10 gift cards, arranges outings, has lunch brought in every week, has the internal recruiters with the games and balloons, will not tell you the denominator in how many fully diluted shares are out there against which you are going to get the measure of your options.

They are all about culture as long as it is positive.

They create the happy face of the ugly financials hidden from prospective and current employees who emotionally mis-price those almost worthless stock options.

The CEO, the VP of Finance are all about “our great culture,” “how we value employees,” growth for our team members—yes, they are all about it until someone asks: “OK, so these 10,000 options you are giving me—what is the fully diluted number of SHARES in your last round?” “Am I getting a small piece of a small pie or a small piece of a big pie?

Will there be any pie left after the VCs take out their preferences?

That VP of People and Culture is not going to tell you that. They want you to not know just how screwed you really are. They know engineers, particularly ones with highly sought after skills, never ask that question.

So it is games, balloons, lunches, backpacks and logo-wear. That’s your culture. They love you, and treasure you as part of the family. They just want you to feel the wealth of those almost worthless options. Some culture!

But as part of the fraud VC-backed companies deliver to employees, and it is fraud although impossible to prosecute, there are those secret-denominator stock options. Each one is a share of the company. Sounds great. But how many shares are out there, Bill?

“Well, don’t worry your little head about that,” CEO Bill says. Just know we have a great culture and we are going to be taking good care of you. Here, this is your lunch from the deli. And your company-logo water bottle. Get back to work.

Management likes to hide their charade with the stock options with the weekly company meeting. This is VC-backed, highly diluted stock option, positive culture theater.

Everyone joins, from everywhere, and there is openness. Here are the financials. In rare cases, here is everyone’s salary. In about all cases, just ask the D question — “So, Bill, just how much are my 10,000 options worth after every VC has been paid? What is the fully diluted denominator?”

See how open your culture is then!

So the 40% rule may be of help to you, option holder.

Now there is one more tool for you to see how rich you really are while the VP of People and Culture tries to hide the ugly financials from you, even though they love you.

Because if you are not meeting that 40% threshold, you are probably facing a down round or a private equity vulture experience.

Your DevOps company has NEVER made a profit? Well, no problem. Better be 40% growth—after all churn, or those options are almost worthless. The CEO does chat often about the growth, so that is pretty public.

But wait! What percent is our loss? Oh, we have lost 15% measured against revenues. Oh, well, then we need 55% growth. Do you have 55% growth there? (55% growth – 15% loss = 40%)

Your company is growing at 35% a year? Well, then that profit better hit 5% or here we go again. Any loss at all puts us under.

Oh, but your management just told you they have 35% growth but are not profitable? OK, this is the other secret number. Just how much of a loss do we have there, Bill? Because if it is 10%, a 35% growth keeps us below the 40% rule.

See how this works?

This is what every engineer should be asking for every SaaS tech company where they interview. There is fierce competition for every engineer.

When you show up for work that first day, there is the MacBook Pro, the back pack, the water bottle, the note pad and the logowear. There is NOT the number showing you how you are screwed on those often fraudulent options.

Every engineer needs to know their denominator for all their options and if they cannot get that number, they know it is probably pretty bad.

So, use the 40% rule instead. What is your growth? What is your loss in terms of revenue? What is that percentage?

If these do not add up to 40% positive, move on.

This company is not going to get funded, or if it does, it will likely be a down round, which, dear option holder, means those options are worth even less than the amount that VP of Great Culture does not want you to know.

But, do ask for some logowear before you say “no.” Great for the gym.