This month, a little known browser testing company is showing how to use accretive financing, with later-stage VC money as a competitive weapon against overly diluted, E, F, G round venture backed competitors. Using a strong cap chart to gain market dominance against struggling market leaders is a well-regarded, although little reported on, competitive strategy.

We have written about Atlassian and Survey Monkey who dominated their markets without early venture capital. Because they made that choice, their success has translated into wealth for their owners and employees. Any money they take in is accretive—it causes acceleration and generates more value than the money itself.

In the software testing tools market, Browserstack, a browser testing firm, received $50 million, for an A Round—from a top tier VC—and they are already profitable, with luminary customers.

It is highly unusual for a VC, and a top tier one at that, to invest this much in an A round. It is almost unheard of. The reason Accel Partners did it is they likely see the chance to make a huge move in the browser and mobile testing market and Browserstack is the horse that can get them there.

Another Atlassian, perhaps?

This is how it’s done. You do the A round AFTER you are deep in the market, profitable, you have prominent customers. You make your move when things are heating up and your competitors are exhausted and diluted from years of effort building a market for you to take from them.

Your employees get real stock, not Venezuelan currency diluted by endless rounds of venture financing. You attract top talent while those in the D, E, F, G Round attract order takers with nowhere else to go.

The browser and mobile testing market is growing. Research reports show customers are just ramping up and the future is getting better for this low level tools business. Companies need to have many of their apps, both internal and customer facing, run on every browser/device combination. This industry will get more attention going forward.

The market is a tools market. Tools are low level, transaction oriented products bought by developers who are often not old enough to vote. The market is typically loyalty-free. Developers choose whatever products they like and are prone to abandon them when something better comes along. It is a cloud market; these tools are used in someone else’s data center. Often the products can be bought using a credit card.

ContingencySales.com is all about helping companies get to market without early venture capital. That does not mean we do not recommend someone ever use venture capital, rather we encourage that one should never use EARLY venture capital.

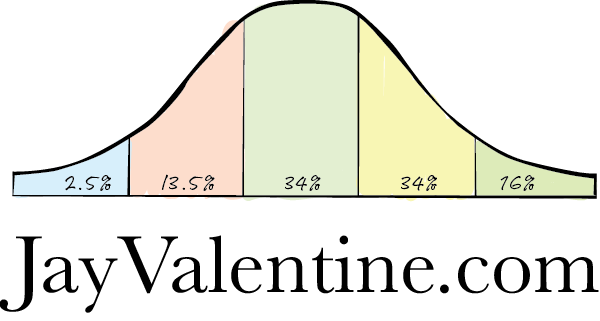

Early venture capital can be dilutive, not accretive. What’s the difference?

Dilutive investments most often come when the company is not profitable, constantly runs out of dough, has 3, 4, 5 sales VPs, and multiple CEOs. Their boards keep investing – bringing on other bottom feeder VCs who they hope will establish their valuation. They are diluting the original investment they made and more quickly diluting the stock options and equity of the employees and founders.

Each round means millions more stock certificates are issued for an asset that is declining or remaining about the same. This is dilution.

These companies may be the ones who were the early entrants–they built the market. Their market building efforts were paid for with years of unprofitable work. They were the pioneers. The market seldom rewards unprofitable pioneers.

Almost always, the founders are long gone as they needed to start other companies after the dilutive early VC investments screwed them out of their founder’s equity. Most of them have learned the ugly lesson of bringing on venture capital “partners.”

Every new VC dollar dilutes the previous dollars in an unprofitable company. Stockholders, usually employees, get screwed. The early VCs may get screwed as well. New VCs revalue the stock, gobble up double dip preferences, give some stock to the CEO and management and take over the “cap chart.” The capital chart is how the dough gets divided up when they sell the company—something they are desperately trying to do.

Accretive investment, like Browserstack, means every dollar invested makes employees RICHER, not poorer. Those dollars are going to capture market share, get more notice from research firms, generate growth, increase value. Meet Browserstack.

One of the secrets of a strong cap chart, like what Browserstack clearly has, is how it can be used as a competitive weapon.

Let’s take an example. Browserstack can now go after a competitor’s largest customers. They can lower the cost of compute enough to take some of them away. Browserstack can drive this market because it has the fuel to accelerate.

Using the cap chart as a weapon, Browserstack can choose to change the market entirely. After all, browser testing is a small part of testing in general. What about performance testing or load testing or U/I likability testing? Browserstack can add these via acquisition because its stock has value. The stock of its competitors, if they are in E, F, G rounds is almost worthless. Would you sell your company to someone with U.S. dollars or Mexican pesos? That is the choice a strong cap chart forces.

Browser testing, whether on a phone or an iPAD or other device, is in many ways driven by the move to e-commerce. Nothing much happens in the e-commerce world that is not impacted by Amazon (a Browserstack customer, it appears). And who is Amazon driving mad? The major retailers–the brick an mortar chains who inhabit the dying shopping malls across America.

Many of the brick and mortar retailers are in financial trouble and are likely allocating dwindling revenue in large part to mobile apps. They call this Omni Channel Marketing.

Browserstack now has the chance, due to a very healthy cap chart, to go to these retailers and deliver generally the same value for half the price. It is all incremental revenue to Browserstack. However, the incumbent competitor, whoever that might be, must keep these renewals–at current prices–or they cannot get any more funding. That is why, dear reader, one needs this lurking, intractable thing called PROFIT.

Browserstack has profit. They do not need to win every incremental deal. But their incumbent competitor must win 90% of them to keep its current valuation.

And over time, they will stop winning 90% or they will discount to win—thus a choice between losing and, well, losing. With $50 million in Series A funding from a top tier VC, Browserstack is about to be a factor in every deal.

“So what” you say? Well, when you are on a D, E, F, G funding round, you are dealing with bottom feeder VCs and all they want is a quick out. They are not looking to fund big strategic moves from a company that has never made a profit. They want to just drive quarter to quarter numbers so they can get this baby sold, fast.

When the bottom feeder VC is in your office, they are telling you how great the future looks. When they are in a partner meeting, they are saying things like “…Browserstack is starting to eat our guys’ lunch. Margins getting even worse. No way we can do another round at this value. Let’s find a way to dump this thing before the bottom falls out.”

Nobody is more skittish than a third tier VC on your board when a well funded firm, with an A tier VC like Accel, is taking away your largest customers. The CEO does not sleep at night.

After all, even they know Accel could have invested in any competitive testing firm, but did not. What does Accel know that they do not?

Accel likely sees the big IPO for the web browser/mobile testing space and they are all over it!

Accel Partners is not a top tier player by accident. Accel Partners’ investment says to the analysts, the Fortune 500 market and to executive buyers—Browserstack is a player and its competitors are now less so. A $50 million A Round Accel Partners’ investment can, by itself, create a market leader.

Accel’s message may well be: “We looked at this market and we like it. We could have invested in anyone but we chose Browserstack because they are not exhausted–they are just getting started.” A top tier VC firm like Accel does not invest $50 million in an A round unless they smell blood and see they can own a market. Pucker time for any E, F, G round testing player who cannot weather a loss of 25% of their renewal dollars. Those days are coming.

That CEO, he or she, knows the Browserstack rep will soon be going after their largest customers telling them “…hey, look at our financials and those of the incumbent. Who do you think will be around in 2 years?” This creates doubt and doubt is the enemy of the weak cap chart firm.

Browserstack will go to their testing competitors’ web sites, read their customer lists and offer each of those customers a similar offering at a lower price. Wouldn’t anyone in this position?

Those are no fun board meetings. The accretive company, Browserstack, has no pressure—they are profitable and these are just additional deals. But the dilutive company, on its E, F, G round, is out of gas. If they lose any customers they get a DOWN ROUND–or get sold, or both.

The down round means the stock is worth even less than the previous round and the cancer sets in.

The accretive company can make big moves–the dilutive company is 100% defensively waiting, every day, for that lost renewal. It will come. When it does, the board will fire the VP of Sales and hire another or fire the CEO. But there can never be an upside because talent is not attracted to dilution. Smart people do not swim toward sinking ships. Executives with nowhere else to go gravitate to these companies who built a market only to lose it to the new, agile, healthy, profitable entrant.

The most sinister part of the equation is that this process makes working at the D, E, F, G venture round company a toxic nightmare.

They hire Sales VPs who drive quarterly revenue, no matter what discounting it takes to get there. It is quarterly desperation time at the end of every quarter as they hope to stay alive a bit longer.

Some of these companies may actually get into daily forecasting at the end of the quarter. Every day, every rep reviews every deal. It is the water torture delivered by the transaction level Sales VP who cannot afford lose this crappy gig.

Quarterly desperation is unscalable. Something always happens. A surprise lost renewal, just one from a large customer means no amount of new revenue can overcome the loss.

Good reps avoid such places like the plague. Headhunters spread the word and the inevitable starts to happen. Lose a few deals here, a big renewal there, then one day, the board announces they sold the company to the likes of a Computer Associates, MicroFocus or other place where software goes to die.

Remember, a VC has only 2 ways to make its dough. They sell the company or they do an IPO.

Accel Partners is likely angling for a Browserstack IPO in the browser testing market and the competitors are —if they are not profitable and on D, E, F, G rounds, going to get sold—so keep those quarterly numbers up, no matter what it takes!

Want to see headcount reduction? Get sold to CA by the VC “partner” who told you they were there for the long run.

A top tier VC like Accel attracts a lot of attention. They can bring in other top tier firms. The dilutive competitor, attracts the little known VC who has no way to get into great investments. VCs know only crap VCs are invested in certain deals, thus lowering their value further. The same equation plays out with talent. The high talent will never go to an E or F, or G round firm as the equity is terrible—they have no upside on the stock.

The gig becomes the bridge to hopefully, please!, something a bit better that will last more than 18 months.

That is why early venture capital is so onerous. If the company is unprofitable, it usually needs round after financing round. Dilution forces out the founding talent. The order takers and mediocre marketing and sales types come–and never leave. Any talent, particularly executive talent, takes a hike so they will not get branded with that place. Quarterly revenue forecasts move to monthly and then to daily—just before death.

Early, dilutive venture capital locks out future strategic moves–making it possible for a new entrant, with not-as-good technology to catch up fast. After all, this is not a market where there are deep product differentiators that the next entrant cannot equal.

Browserstack is doing it right. They were able to survive, it appears on one or two meals a day as the market matured. As others built a browser or mobile testing market with dilutive equity, now long gone, Browserstack stayed alive. Now, with a $50 million A round, from an A-level venture company, they are making a big, strategic move.

Browserstack is in the lead for an IPO–that will bring in probably $100 million or more in fresh funding–again, accretive acceleration. Some of its competitors—financially exhausted will have its employees Googling what it is like to work for CA or MicroFocus.

This is how it’s done.